iTrustCapital Wallet – Secure Management of Digital Assets

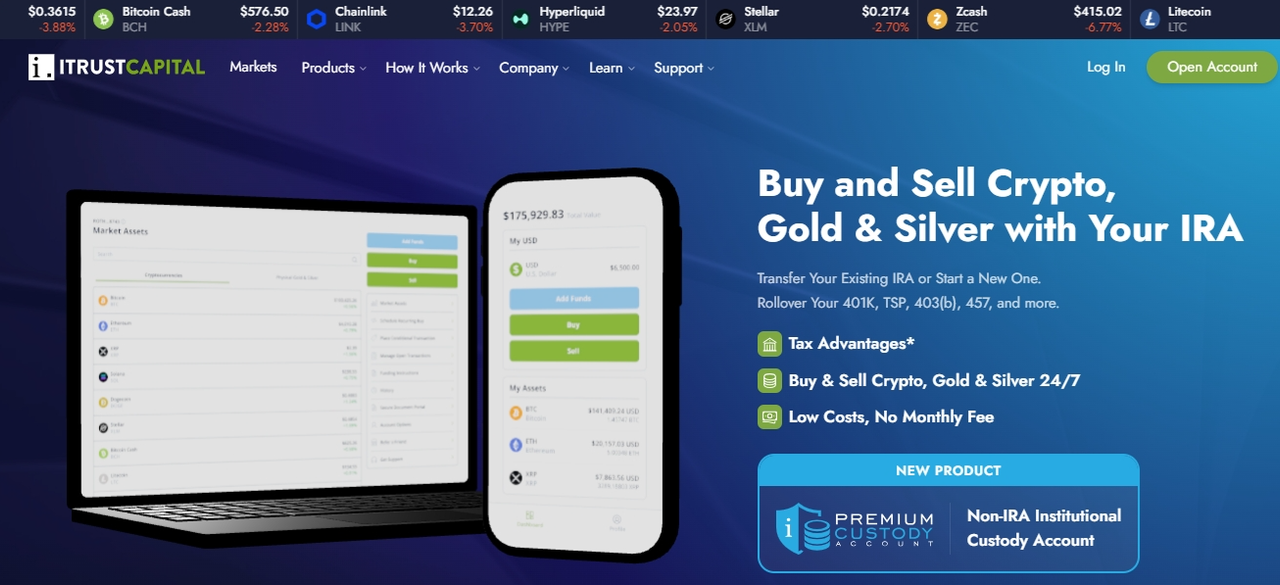

The iTrustCapital Wallet is a custodial solution that allows individuals to manage cryptocurrencies and precious metals within a regulated framework. Unlike self-custody wallets, where users hold private keys independently, the iTrustCapital Wallet provides secure storage through trusted custodians and regulated partners. It is designed for individuals who want to manage digital assets and precious metals within tax-advantaged retirement accounts or Premium Custody Accounts.

This wallet combines security, convenience, and compliance, offering an accessible platform for users to build diversified portfolios while ensuring their assets are held safely.

Key Features of the iTrustCapital Wallet

Multi-Asset Support

The iTrustCapital Wallet enables users to hold a variety of assets in one platform. Supported cryptocurrencies include Bitcoin, Ethereum, Solana, and other popular digital currencies. In addition, users can hold precious metals such as gold and silver in secure storage facilities. This multi-asset support allows for portfolio diversification without requiring multiple wallets or platforms.

Institutional-Grade Security

Security is central to the iTrustCapital Wallet. Rather than relying on hot wallets connected to the internet, digital assets are stored in institutional-grade cold storage. Custodians use advanced security protocols including multi-party computation, hardware security modules, and strict access controls. Many custodial partners also provide insurance coverage to protect against theft or loss, offering additional peace of mind.

IRS-Compliant Custody

For individuals holding assets within retirement accounts, the iTrustCapital Wallet meets IRS requirements by utilizing qualified custodians. This structure allows users to manage digital assets and precious metals within traditional, Roth, or SEP IRAs while maintaining compliance with federal regulations. Using a custodial wallet ensures that assets are segregated and managed in accordance with regulatory standards.

Secure Transactions and Management

The iTrustCapital Wallet simplifies transactions for users. Deposits are made using a linked bank account, allowing funds to be converted into digital assets or precious metals. Users can buy and sell supported assets directly through the platform, with all transactions approved and executed under the custodial framework. Withdrawals are generally restricted to fiat currency for retirement accounts, ensuring compliance with tax and regulatory guidelines.

How the Wallet Works

The iTrustCapital Wallet functions as a custodial account, meaning that the platform holds the assets on behalf of the user. Users manage their holdings through a secure interface, while the custodians store and protect the assets. This approach reduces risks associated with personal key management, such as lost or stolen private keys, and eliminates the need for users to directly manage technical security measures.

Transactions are executed through the platform, with each trade, purchase, or sale processed under the custody agreement. Users receive confirmations of all actions and can monitor account balances, portfolio performance, and transaction history in real-time.

Security and Account Protection

Beyond institutional custody, the iTrustCapital Wallet includes additional security measures to protect accounts. Two-factor authentication (2FA) is used to secure logins, ensuring that only authorized users can access their accounts. All communications are encrypted using bank-level encryption protocols.

The wallet also incorporates identity verification procedures to prevent unauthorized access. Certain withdrawals and account actions require verification calls or additional authentication steps, adding another layer of protection. By combining custodial safeguards with personal security measures, the iTrustCapital Wallet aims to provide a safe and reliable environment for digital asset management.

Benefits of Using iTrustCapital Wallet

Simplified Management – Users can manage multiple asset types in one platform without juggling several wallets.

Reduced Risk – Custodial storage protects against hacking and the loss of private keys.

Compliance-Friendly – Suitable for retirement accounts and other regulated structures.

Portfolio Oversight – Users can track balances, transaction history, and asset performance easily.

Accessibility – Designed to be user-friendly for both beginners and experienced investors.

Who Should Consider the Wallet

The iTrustCapital Wallet is ideal for individuals who want to hold digital assets and precious metals in a secure, regulated environment. It is especially useful for those looking to:

Include cryptocurrencies in tax-advantaged retirement accounts.

Manage diversified portfolios without handling private keys directly.

Avoid the risks and technical responsibilities of self-custody wallets.

Benefit from institutional-grade storage and security measures.

While it is not a traditional self-custody wallet where users control their private keys, it provides a compliant and convenient solution for long-term investors and retirement-focused users.

Final Thoughts

The iTrustCapital Wallet provides a safe and structured approach to managing cryptocurrencies and precious metals. By combining institutional custody, advanced security measures, and user-friendly account management, it offers a secure platform for users seeking diversified investment options.

For anyone looking to hold digital assets in a regulated, compliant, and well-protected environment, the iTrustCapital Wallet provides a clear and reliable solution, making it easier to manage digital assets without the complexities and risks of self-custody.